Jeevan Saral Maturity Sum Assured Calculator

The maturity sum assured is calculated based on your entry age and the premium that you have paid. Benefits of LIC Jeevan Saral.

Lic Of India Agent Commission Chart 2020 In 2021 Life Insurance Quotes Life And Health Insurance How To Pass Exams

On maturity the benefit paid would be calculated as follows Maturity benefit maturity sum assured loyalty additions.

Jeevan saral maturity sum assured calculator. 37 rows LIC Jeevan Saral plan is also known as atm plan. LIC Jeevan Saral Plan Table No 165 Maturity Calculator. MSA Maturity Sum assured printed on the LIC Jeevan Saral Policy bond.

Jeevan Saral calculator maturity benefit. How to Calculate Loyalty addition and Maturity in LIC Jeevan Saral Plan no 165. 60650 and term is 21 years.

21years Monthly premium400 Accident benefit. The maturity sum assured is calculated based on your entry age and the premium that you have paid. Income Tax Benefit Available under Section 80 C for premiums paid and Section 10 10D for Maturity returns.

Lic Maturity Amount Calculator provides maturity amount based on Age of the policyholder Policy term Policy name Sum Assured etc. 165 Features Date of Withdrawal. LICs Jeevan Saral Plan 165 Key features.

Please note the annual returns calculator uses following calculation Compounding interest with base amount as zero and monthly deposit of Rs 1500 and compounded yearly. Also refer premium of your policy and calculated. The LIC Jeevan Saral Policy is an endowment plan which is non-unit linked insurance plan policy under LIC Life Insurance Corporation of India with Double DeathBenefit of Sum Assured Return of Premium.

Jeevan Saral Maturity calculator helps to calculate maturity amount using maturity sum assured and declared loyalty addition. There are two types of Sum Assured in Jeevan Saral a Death Sum Assured b Maturity Sum Assured. Premiums paid are exempted from income tax-free for Jeevan Saral policy under Sec 80 C.

The policyholder can choose his own premium amount and Maturity Sum Assured as well as Death Sum Assured is subsequently determined based on the premium paid by him. The maturity proceeds of Jeevan Saral are also exempted from tax under Section 10 10D. Death Benefit On the death of the life insured before policy maturity Sum assured with Loyalty Addition will be paid.

Death coverage shall be the sum of 250 times the monthly basic premium Death Sum Assured Premium paid excluding the first year premium and rider premiums Loyalty. My Annual premium I pay it every half year a Rs. It is an endowment policy available only.

This is how the calculator will be used by the customers based on which they can opt the policy according to their reasonable premiums. This data will be used to calculate and determine. I have purchased a Jeevan Saral With profits policy from LIC through my agent.

The policyholder can choose the premium amount and Maturity Sum Assured as well as Death Sum Assured is subsequently determined based on the premium selected by him. Death coverage shall be the sum of 250 times the monthly basic premium Death Sum Assured Premium paid excluding the first year. It also depends on the policy tenure.

LIC Jeevan Saral in Hindi LIC Jeevan Saral Plan Details - Table No. Why did this happen. Death Sum assured which is 250 times the monthly premium excluding rider premium if any.

165 total maturity amount. Home Products Withdrawn Plans LICs Jeevan Saral Plan No. Under Jeevan Saral the Sum Assured is a multiple of your monthly premium.

Hence it is categorized under Special Plans. I request your help on the below mentioned query. If you do not have this plan and want to know about this Please Click Here to calculate all details as per age term and premium.

The maturity sum assured which was paid to him after 12 years was a mere Rs24575 plus bonus amounting to Rs34405. Find here the simple online calculator to calculate the benefits of the Jeevan Saral Policy which is an LIC policy. It also depends on the policy tenure.

And they have highlighted many such cases in their other articles. 165 LIC Jeevan Saral is actually an endowment policy with a lot of flexibilities that is usually available only with unit linked insurance plans. If you do not have this plan and want to know about this Please Click Here to calculate all details as per age term and premium.

Please enter correct sum assured premium premium paying term policy term last premium paid date and your personal details. To calculate loyalty addition in your policy refer your policy bond to know the Maturity Sum Assured. The Maturity Sum Assured depends on the age at entry of the life to be assured and is payable on survival to the end of the policy term.

This plan offers Double Death Benefit of Sum Assured Return of Premium. Maturity Return - Maturity Sum Assured Premiums paid with Loyalty Addition will be paid on Policy maturity. The calculator will display the maturity amount the death claim amount.

The maturity amount in LIC Jeevan Saral Table No 165 is Maturity Sum Assured MSA Loyalty Addition LA declared in the year of maturity. Maturity Sum assured which is also printed on the policy bond while issuing the policy. To calculate the maturity amount the Jeevan Saral Maturity Calculator evaluates the maturity sum assured based on the entry Age at the time of buying the LIC policy Premium and Term and adds the Loyalty Addition to give you the approximate maturity value.

On maturity the benefit paid would be calculated as follows Maturity benefit maturity sum assured loyalty additions. The maturity sum in the LIC Jeevan Saral Plan of LIC is Loyalty Addition LA Maturity Sum Assured MSA declared in the maturity year. Sum assured 100000 Term.

For calculation of maturity amount this maturity calculator calculates maturity sum assured as per entered Age at the time of purchase Term and Premium and adds Loyalty addition to provide approx maturity value. The Maturity Sum Assured plus Loyalty additions if any is payable in a lump sum. LIC Jeevan Saral Plan 165 Key features.

LIC Jeevan Saral calculator gives you a fair estimate of the surrender value bonus Loan paid up and projected maturity value on the basis of the total premium paid. Before I purchased this policy my agent had shared a Returns. Atal Pension Yojana APY Employees Provident Fund EPF - All You Need to Know.

Rs 1500 monthly Returns calculator. LIC Jeevan Labh 836 Sum Assured Calculator. LIC New Jeevan Anand Plan 815 Sum Assured Calculator.

Jeevan Saral calculator maturity benefit. Read complete details of Jeevan Saral Plan. Here I am using this to calculate LIC JEEVAN SARAL PLAN NO.

Calculation of Sum assured for LIC Jeevan Saral. You need to provide these details in the Lic Maturity Value Calculator along with Name Mobile number Email ID to calculate the maturity value in an easy way.

Lic Jeevan Saral Maturity Calculator Benefits Features 2021 Updated

Lic Jeevan Sugam Life Insurance Marketing Ideas Life Insurance Corporation Life Insurance Marketing

Lic S Jeevan Tarang 178 Details With Calculators Insurance Funda

Lic Jeevan Saral Plan No 165 Returns Unbounded

Lic Jeevan Saral Plan 165 Premium Maturity And Benefits Calculator Insurance Funda

Lic Jeevan Saral Plan 165 Details Calculators Review And Illustrations Insurance Funda

Lic Jeevan Saral Plan 165 Premium Maturity And Benefits Calculator Insurance Funda

Premium And Maturity Calculator Lic Jeevan Tarun 834 Insurance Funda

Lic Help Blog Get Up To 100 Of Maturity Sum Assured After 5 Years Of Premium Payment Flexibility Of Liquidation As Profitable Business How To Plan Insurance

Lic Jeevan Shree 1 Plan 162 Maturity Calculator With Details Insurance Funda

Lic Jeevan Labh 936 Indepth Analysis And Maturity Calculator Insurance Funda

Lic Jeevan Saral Plan 165 Details Calculators Review And Illustrations Insurance Funda

Lic Jeevan Saral Plan No 165 Returns Unbounded

Life Insurance Endowment Plan Return Calculation Using Ms Excel

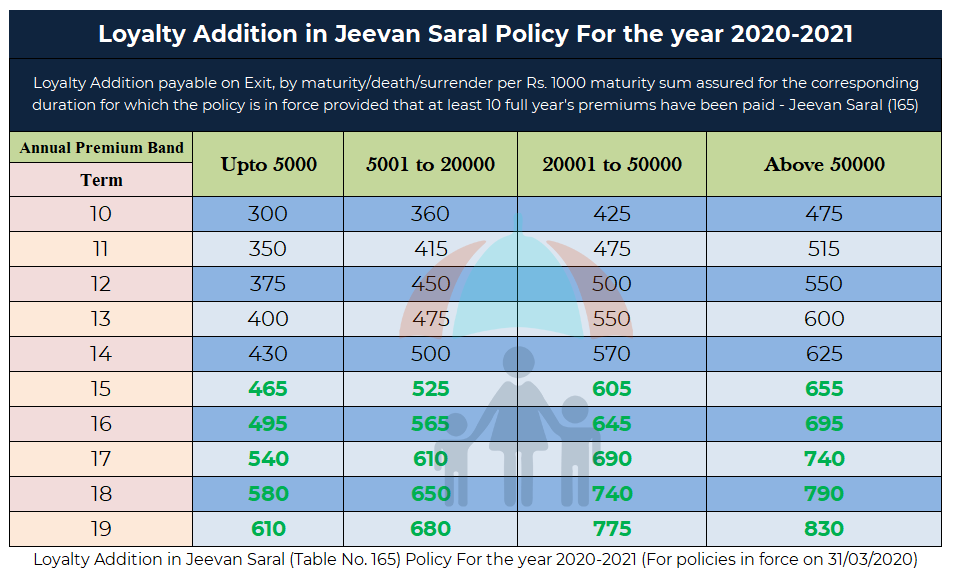

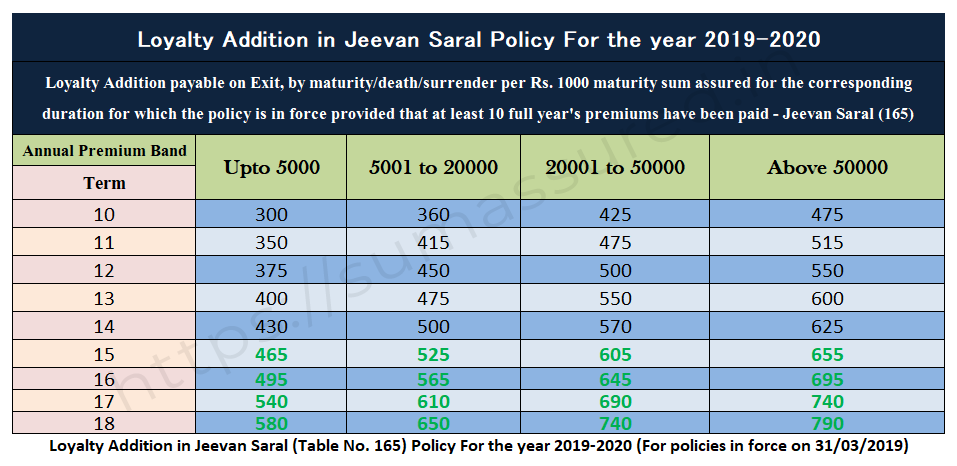

Loyalty Addition In Jeevan Saral Policy Sum Assured

Loyalty Addition In Jeevan Saral Policy Sum Assured

Lic S Jeevan Saral Why So Much Confusion

Lic Jeevan Saral Plan Review Key Features Benefits

Posting Komentar untuk "Jeevan Saral Maturity Sum Assured Calculator"