Bank Assurance Means

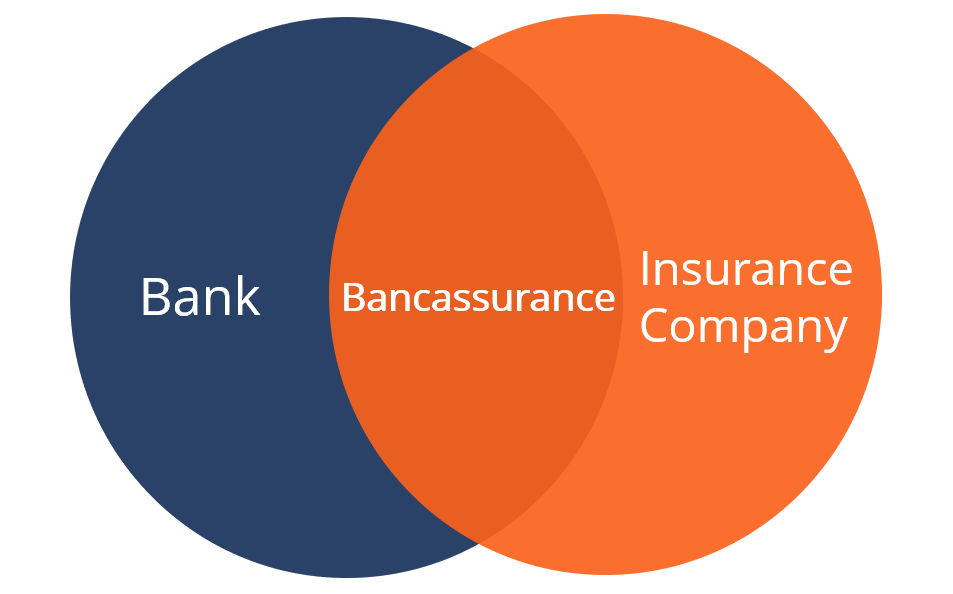

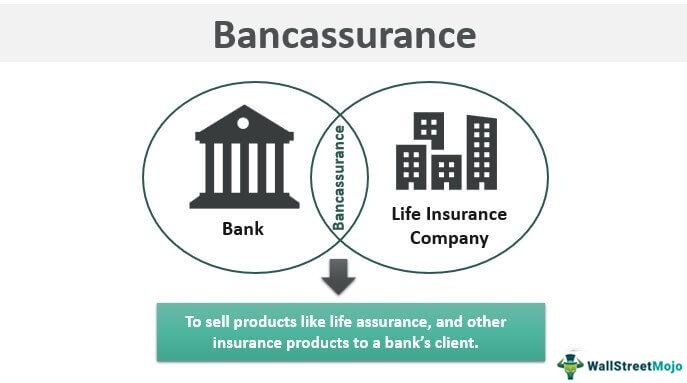

Banks and insurance company come up in a partnership wherein the bank sells the tied insurance companys insurance products to its clients. Assurance to bank with one bank.

![]()

Advantages Of Bancassurance For Customers Banks Insurance Carriers

1 Assurance given by banks to Loanees 2 Assurance to bank with one bank 3 Assurance to repay loans 4 Selling insurance products through banks.

Bank assurance means. Bancassurance arrangement benefits both the firms. Assurance to repay loans 4. Bank assurance means -.

C Life policy issued to the bank on the life of their staff d Assurance given to bank by general insurance companies for insuring assets of the banks. Its similar to insurance and used interchangeably. The beneficiary is the one who takes the guarantee.

Assurance given by banks to loaners 2. And the applicant is the party who seeks the bank guarantee from the bank. Selling insurance products through banks.

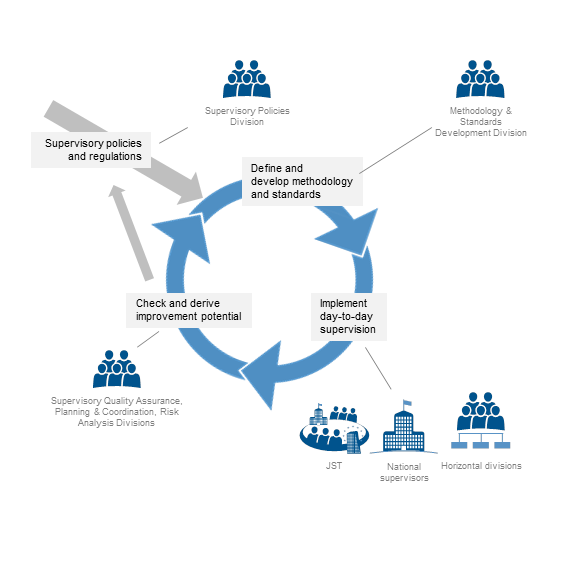

Means distribution of insurance products through the distribution channel of banks It is packaged service of banking and insurance products offered to customers at one place under one roof and at one time. Something has happened that has raised the question of whether more assurance is needed. Organization An assurance framework is a structured means of identifying and mapping the main sources of assurance in an organisation and co-ordinating them to best effect.

For example a bank offering a mortgage may require borrowers to buy homeowners insurance. 3 Assurance to repay loans. B Assurance given by banks to its customers.

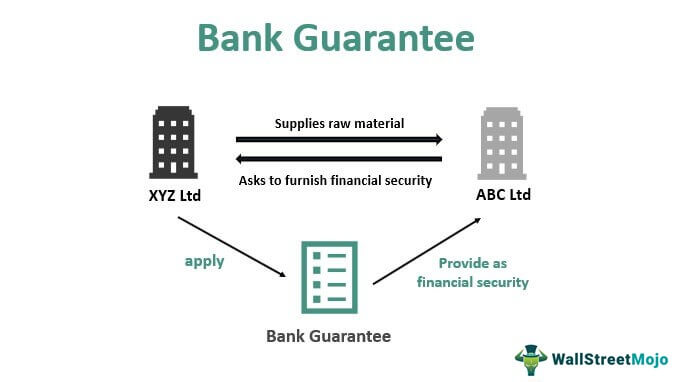

Define BANK GUARANTEE A guarantee assurance by a bank on behalf of his customer to a third personparty for payment of certain sum. Bancassurance simply means selling of insurance products by banks. Proponents argue that bancassurance can streamline internal and government regulations.

Assurance to give good service 5. Assurance to repay loans. Selling insurance product through bank.

Assurance to bank with one bank 3. As the author expressed have seen quality assurance in banks seeks primarily to maintain quality through a combination of accreditation assessment and audit. 4 Selling insurance products through banks.

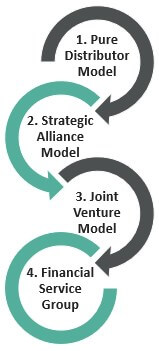

There are several of approaches to quality assurance each of which incorporates various combinations of self- assessment audit or peer review and performance indicators. On the one hand the bank earns fee amount non interest income from the. Bancassurance means a Distribution of Insurance policies both life and non-life by banks as corporate agents through their branches.

26 Assurance mapping is a mechanism for linking assurances from various sources to the risks that threaten the achievement of an organisations outcomes and objectives. Under the RBIs SDR scheme banks canconvert their loans into equity acquire a majority stake in the firm and bring in new promoters Here the term SDR means The term Paper Gold means Short-term assets representing amounts due toa vendor or suppliers of goods. To him third person in case his customer fails to pay or fail to fulfill any contractual or legal obligations towards such third person.

Bancassurance Insurance provided by a bank. Bank assurance means. BGs are an important banking arrangement and play a vital role in promoting international and domestic trade.

Means the selling of insurance and banking products through the same channel most commonly through bank branches selling insurance. Bank Guarantee BG is an agreement between 3 parties viz. 1 Assurance given by banks to Loanees 2 Assurance to bank with one bank 3 Assurance to repay loans 4 Selling insurance products through banks.

1 Assurance given by banks to Loanees. 2 Assurance to bank with one bank. This could be as routine as a director reviewing an assurance map and finding a place where a changing situation means that further assurance would be useful.

Bancassurance means selling insurance product through banks. Assurance given by banks to Loanees. For example a bank could offer life insurance in addition to its savings loan and investment services.

Assurance is financial coverage that provides remuneration for an event that is certain to happen. Bank assurance means -. Bancassurance is used to describe the partnership or relationship between a bank and an insurance company whereby the insurance company uses the bank sales channel in order to sell insurance products.

For more support on assurance terminology see our assurance glossary. If bancassurance is. The bank the beneficiary and the applicant.

Why might assurance be needed.

![]()

Advantages Of Bancassurance For Customers Banks Insurance Carriers

Banker S Acceptance Definition Example Benefits

![]()

Advantages Of Bancassurance For Customers Banks Insurance Carriers

Bancassurance Meaning Types What Is Bancassurance

Bancassurance Meaning Need And Advantages Mba Knowledge Base

Insurance Definitions Features

Bank Guarantee What Is It Example Feature Types Limit Importance

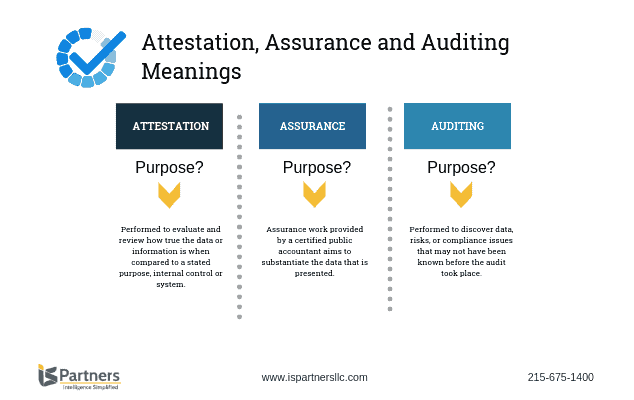

Defining Attestation Auditing Assurance I S Partners Llc

Bancassurance Overview Challenges And Going Digital

![]()

Advantages Of Bancassurance For Customers Banks Insurance Carriers

Bancassurance Meaning Types What Is Bancassurance

Advantages Of Bancassurance For Customers Banks Insurance Carriers

Bank Guarantee Meaning Types How Does It Work

How Insurers Differ From Banks Implications For Systemic Regulation Vox Cepr Policy Portal

Bancassurance Meaning What Is Bancassurance Guide For Beginnersaegon Life Blog Read All About Insurance Investing

![]()

Advantages Of Bancassurance For Customers Banks Insurance Carriers

How Insurers Differ From Banks Implications For Systemic Regulation Vox Cepr Policy Portal

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Posting Komentar untuk "Bank Assurance Means"