Pension Term Assurance

It cannot be used as security against a mortgage. Pension Term Assurance and the LTA.

Get Tax Relief On Life Insurance With Pension Term Insurance Lion Ie

The cost is guaranteed not to increase before that date unless you.

Pension term assurance. While this kind of policy is no longer available to new customers those with such policies active are still entitled to continue them and to. Pension Term Assurance The truth behind the hype Rod McKie Stephen Griffiths So whats the truth behind the hype. Any resource link to evidence your view would be appreciated.

Hopefully a quick one. How did distributors respond to PTA. Rolls-Royce reveals its first fully electric car arriving in 2023.

Employers receive corporation tax relief on life cover payments. A term assurance policy will be set up for a specific number of years. Quite simply this is a Term Assurance policy that is structured to use the tax relief that is currently available under Pensions legislation and you dont even need to have a Pension plan to benefit from this type of policy.

Contributions paid by or on behalf of a member to a registered pension scheme to purchase personal term assurance will not be relievable pension contributions unless they relate to a protected. Until the end of 2006 pension term assurance was available as a form of life insurance that could be bought as part of a pension plan complete with the associated tax breaks. Pension Term Assurance is designed to provide Life Cover to those in non-pensionable employment.

This includes self-employed people or people who are not members of an employer-sponsored pension plan. Contributions to an approved Personal Pension Term Assurance plan may qualify for tax relief. Ive looked in HMRCs PTM and cannot find reference to pension term assurance under the authorised lump sums sections so.

Spouses or dependents pension. Pension Term Assurance is life cover that pays out a lump sum if you die during the term of the plan. Pension term assurance policies have implications for annual allowance.

A major attraction of a Pension Term Assurance policy is that currently if. In this case the protection is for your family or other financial dependents as it will provide them with a payment in the event of your death. If you die during this term ie.

Revenue maximum death benefits includes benefits from company pension schemes. July 2017 in Technical stuff. The advantage of this type of life cover is that it costs less because you may be eligible to claim tax relief on your contributions up to certain limits.

Did innovation or me too products lead the way. Lump sum of up to four times final salary and. If you are employed and paying into a pensions-term assurance contract you will avail of 6pc PRSI relief on the monthly cost of the cover also.

It is available to employed or. Click to open Pension term assurance This provides life cover to run alongside a pension arrangement and the premiums paid enjoy the same tax concessions as they qualify for income tax relief. Pension Term Assurance also known as a Section 785 policy can be used by those not covered by a company pension scheme to protect their families in the same way as a traditional level term assurance policy.

Pension Term Assurance from Royal London is a special type of Term Assurance designed to provide Life Cover to those in nonpensionable employment. Pension Term Protection is life insurance designed to protect your family financially if you die before you retire. How did protection providers respond to A day.

Pension Term Assurance is life cover that pays out a lump sum if you die during the term of the plan. With Pension Term you can potentially reduce the cost of your life cover by up to 40. You can avail of the benefits of Pension Term Assurance and protect your family and their financial security provided you are.

Pension Term Assurance is a type of life insurance that covers the period of time up until retirement. Britains Garage of the Year 2021 nominees incredible construction. It is important to note that tax relief is not automatically granted.

What is Pension Term Assurance. A term assurance policy is a type of protection insurance. You pay a regular amount of money into your Pension Term Policy.

If you die during this specified term the policy will pay out so that your dependents are cared for financially. This is known as the term. If the life assured survives until the end of the term the policy will expire and there will be no monies payable.

Under this plan you pay a set amount on a regular basis usually by direct debit until you retire. You must apply to and satisfy the Revenue requirements. Pension Term Assurance offers valuable protection with tax savings you can protect your familys future in the event of your death occurring before you retire and you get the added bonus of tax relief at your marginal rate of tax.

Revenue limits terms and conditions apply. Your contribution can provide the level of life cover you need until the date you have chosen for retirement. Pension term assurance.

Pension term assurance explained. The sum assured under the policy is only paid out if death occurs within a specified term. What impact did PTA have on pricing.

Term Assurance is life insurance in its cheapest form. Despite what the name might suggest Pension Term Assurance does not have to form part of a pension. Pension Term Assurance is the most tax efficient way to take out life cover as the premiums qualify for tax relief at your marginal highest rate however there is no relief in respect of PRSI and the Universal Social Charge.

What has the impact been on existing business. Company pension term assurance is for PAYE employees with no requirement to be in a company pension. Before your selected retirement date your family will receive a payment to ensure they do not suffer financial hardship.

Therefore if you are earning over 45400 in. The cash lump sum is payable to the policyholders estate or to a nominated individual in the event of death within the term of the policy. Is the payment of death benefits from a PTA policy a BCE.

There are several types of Term Assurance. Eligible policyholders pay their full premium to Royal London and then claim tax relief at their marginal rate from Revenue. This includes for example a selfemployed person or someone who is not a member of an employersponsored Pension plan.

A retirement expert has raised concerns at how an existing pension term assurance policy can.

Get Tax Relief On Life Insurance With Pension Term Insurance Lion Ie

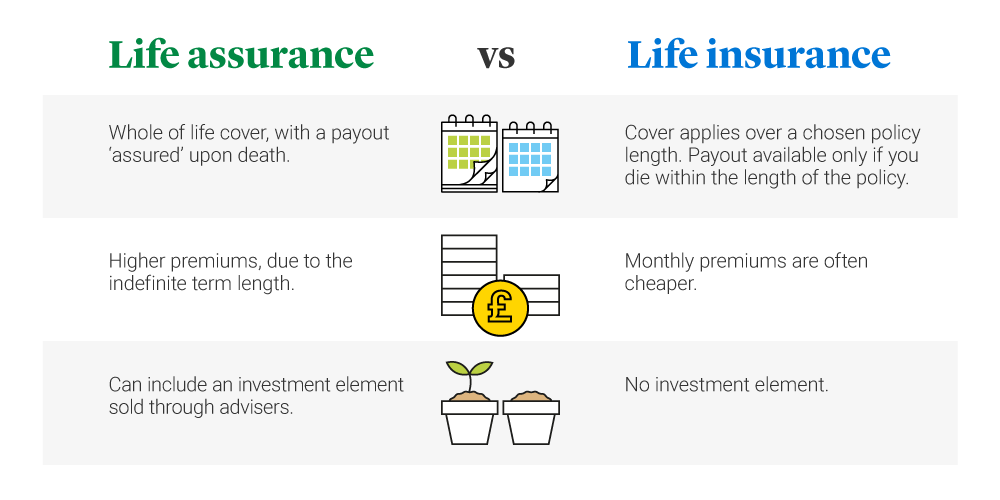

Life Assurance Vs Life Insurance Legal General

What Happens To Pension Policies And Life Assurance Policies The Deceased Held At Death Low Incomes Tax Reform Group

Retirement Pension Plans Canara Bank

Pension Vs Annuity Top 7 Differences You Should Know

Get Tax Relief On Life Insurance With Pension Term Insurance Lion Ie

Term Assurance Introduction Phoenix Life

What Is An Annuity Meaning Definition Benefits Types

Find Your Policy Type What Type Do I Have Phoenix Life

Pension Jargon Buster Low Incomes Tax Reform Group

Ceylinco Life Pension Saver Ceylinco Life Insurance

Find Your Policy Type What Type Do I Have Phoenix Life

Pension Life Insurance Irish Life

Sbi Life Saral Pension Plan One Of The Best Retirement Policy In India

Posting Komentar untuk "Pension Term Assurance"