Life Assurance Bond Taxation

Unfortunately clients acting on their own initiative are often unaware of the downsides and the triggering of unexpected and unwelcome bond. Because they have their own unique tax rules policyholders and on occasion tax practitioners are sometimes in a muddle over the tax treatment.

The tax basis for life assurance in the UK has already changed from Solvency I to IFRS 4 or UK GAAP.

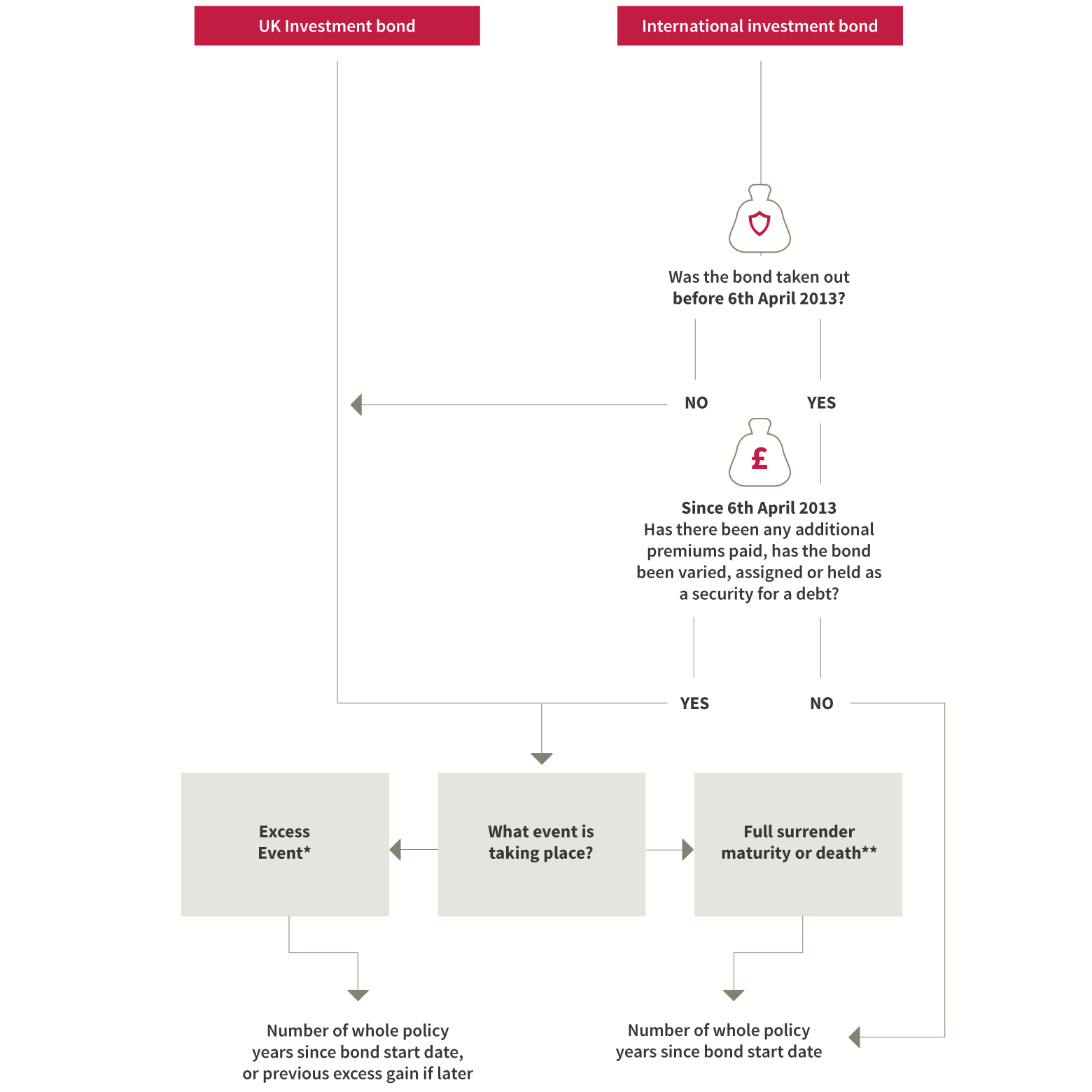

Life assurance bond taxation. Investment bonds are a type of life insurance paid for with a single lump-sum deposit at the outset rather than monthly premiums. In this months article we consider the tax implications which can arise in two situations under a life assurance single premium investment bond Bond on death both of which can give rise to confusion. The HS320 Gains on UK life insurance policies 2021 has been added.

The first situation is where the sole owner of a Bond dies but the Bond remains in. Such advantages became even more relevant in light of the recent change in the Israeli Tax Ordinance-1961 Ordinance. Investment bond is the general term for a single premium non-qualifying whole of life insurance policy.

Both companies are fully authorised Isle of Man resident life assurance companies that have been granted tax-free status by the Isle of Man government. 17 rows This manual provides guidance on the corporation tax treatment of insurance. The Capital and Income Bond enables you to spread and adapt your investments as you wish according to your financial goals and your attitude to risk.

In this article we provide a brief summary of the advantages associated with the use of insurance wrappers for both asset protection and tax planning purposes. The 45 trust rate will only apply if the settlor is dead or non-UK resident. Offshore investment bonds are issued by international insurance or life assurance companies based in low or no tax jurisdictions like the Isle of Man and Dublin where there are often investor protection schemes in place making them of maximum appeal to onshore and offshore investors.

Standard Life Assurance Limited is registered in Scotland SC286833 at Standard Life House 30 Lothian Road Edinburgh EH1 2DH. The majority of investment bonds are written on a life assurance basis. Of advantages over a Life Assurance variant in that it can provide increased simplicity and flexibility for individuals trustees and corporate investors who wish to engage in long-term tax or succession planning as follows.

A new version of the helpsheet has been added for the 2019 to 2020 tax year. Any chargeable event gain arising on the encashment by the personal representatives will be treated as income of the estate and the personal representatives will be liable to tax on that gain. Wrap SIPP and Wrap Onshore Bond are both provided by Standard Life Assurance Limited which is part of the Phoenix Group.

Gains on absolute trusts are generally looked. In this months article we consider the tax implications which can arise in two situations under a life assurance single premium investment bond Bond on death both of which can give rise to confusion. Assigning to a beneficiary can avoid tax at the trust or settlors rates of tax.

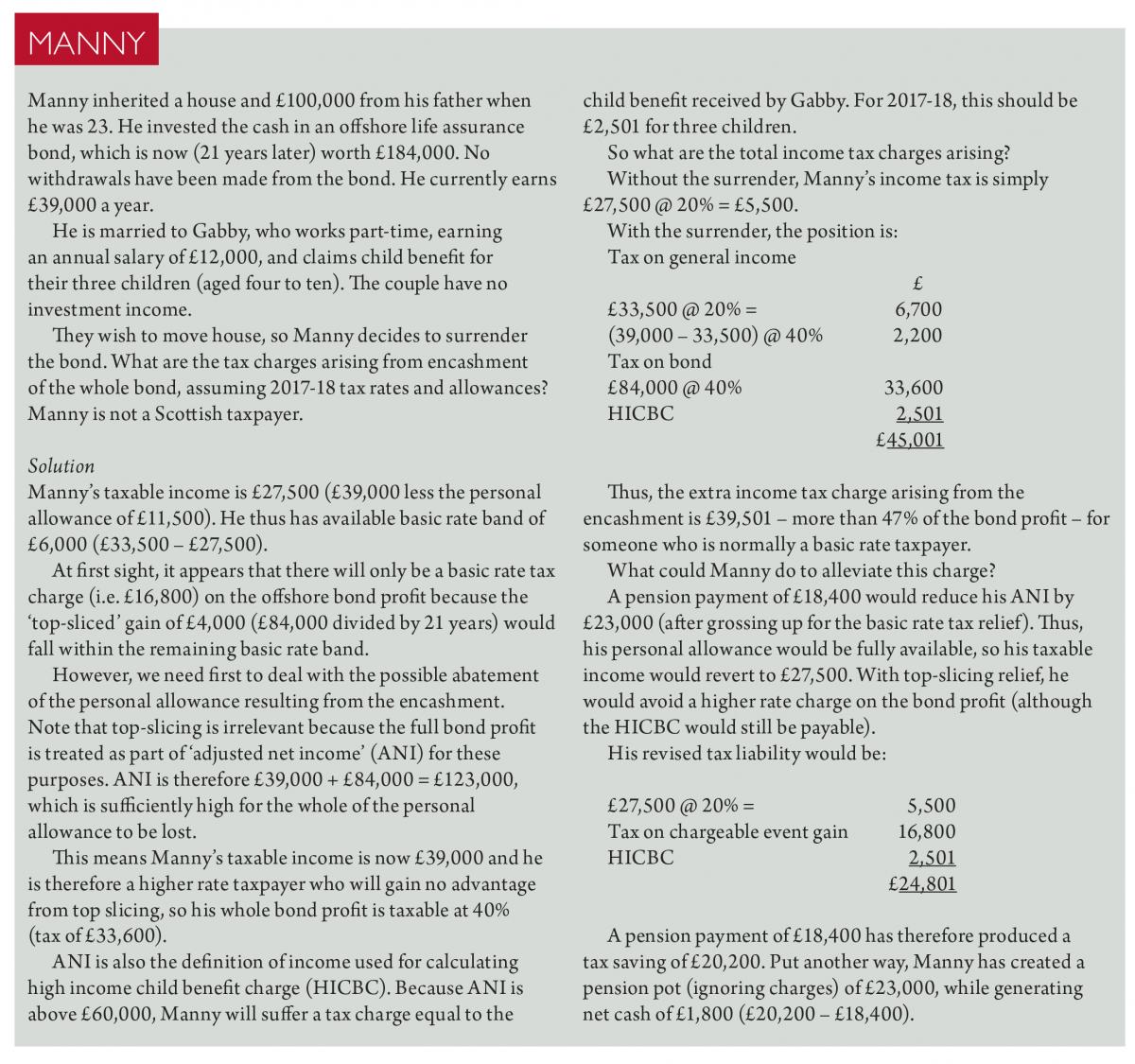

This means a small amount of life cover will be paid on the death of the life or lives assured in addition to the investment value. This article continues the series on the subject of life assurance bond taxation and should be read with the earlier more general articles as some of the basic points about the methodology of the tax calculation will not be repeated top slicing 5 withdrawals etc. The lives assured are not liable for tax on any bond gains unless theyre also the owners.

This means they have a different tax treatment from other types of investments. Regular premiums may also be paid into certain Investment Bonds. It also includes Zurichs With Profi ts Bond Portfolio Investment Bond.

Assignments of life policies into and out of trust would normally be purely by way of gift and so would not create any income or capital gains tax problems. Investment bonds can be a tax-efficient investment option and can be a good alternative to traditional term life. A guide to tax on your UK investment bond Investment Bonds offered by Prudential now or in the past are normally set up as single premium life assurance policies.

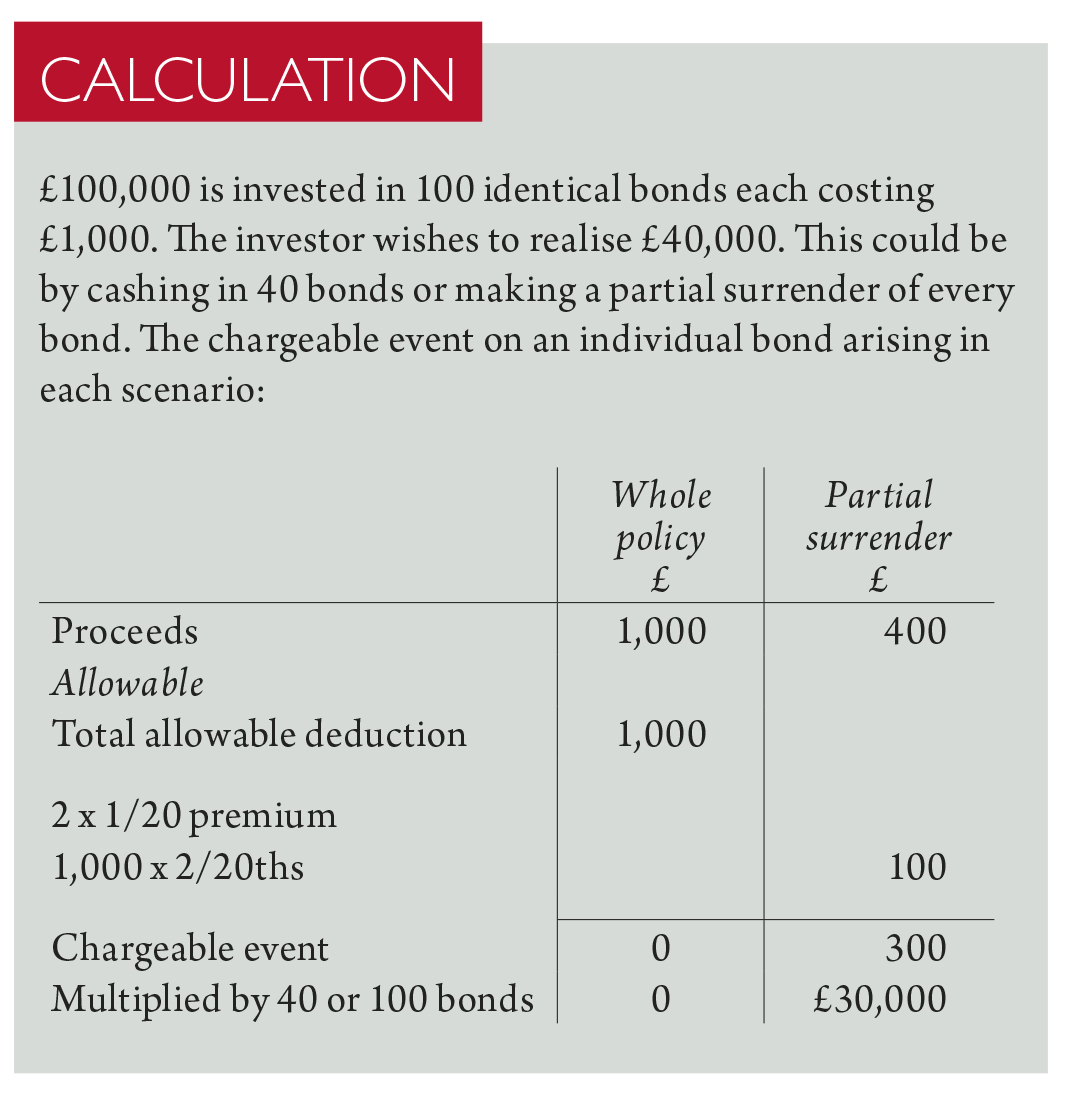

The full surrender is called a related transaction. This means we recognise the fact that the life fund has suffered tax at a rate equal to basic rate. Now lets assume that Fair Value Ltd encashes the bond in April 2022 for 127500.

How is my investment taxed. This disposal occurs in APE 31 March 2023. In this guide the term covers policies issued or administered by Zurich Assurance Ltd.

The first situation is where the sole owner of a Bond dies but the Bond remains in force as an asset of the deceased owners. Bonds in trust do not follow the normal trust taxation rules. Not having to appoint individuals as lives assured may make this version a.

In the case of a bond the personal representatives might encash where the beneficial owner has died but the bond has continued due to the existence of another life assured. Life insurance investment bonds. The settlor can reclaim any tax they are liable for from the trustees.

The bond has therefore not changed in value since 31 March 2022. Single premium investment bonds and death. We also issue investment bonds from Ireland by Canada Life International Assurance Ireland DAC which is not subject to Irish tax where the policyholder is resident outside Ireland.

Theyre sometimes known as single-premium life insurance policies. The life assurance bond has its tax downsides although many of these can be avoided with careful planning. This has resulted in new legislation in Finance Act.

The Investment Bond available through Life Companies has existed since the early 1970s if not earlier. It will change again as accounting standards are updatedAmended Solvency II 11 November 2013 Page 19 Tax in technical provisions UK GAAP Retains modified statutory solvency basis. Separate advice as their tax position can be more complex.

Part assignments have been the cause of much debate and disagreement between the life industry and the Inland Revenue. Because it is structured as a life assurance policy it also offers the opportunity to take advantage of certain tax benefits depending on your personal circumstances and requirements. Using insurance wrappers for asset protection and tax planning.

Investment Bonds What Are They And How Do They Work Uk Care Guide

The Spanish Compliant Investment Bond Some Tips Axis Finance Com

Chargeable Events On Life Assurance Bonds Taxation

Investment Bonds What S Your Exit Strategy Tilney

Onshore Bonds A Product Of The Past Or Tax Wrapper Of The Future Sanlam

Chargeable Events On Life Assurance Bonds Taxation

Chargeable Events On Life Assurance Bonds Taxation

What Happens To Pension Policies And Life Assurance Policies The Deceased Held At Death Low Incomes Tax Reform Group

Chargeable Gains And Top Slicing Briefing Note Canada Life Uk

Bonds Or Collective Investments Ppt Download

Life Assurance Policies For The Returning Expat Australia The Sovereign Group

Investment Bonds And Collective Investments Sanlam

Taxation Of Bonds Held In Trust Briefing Note Canada Life Uk

Bonds Or Collective Investments Ppt Download

What Tax Do I Pay On Savings And Dividend Income Low Incomes Tax Reform Group

Posting Komentar untuk "Life Assurance Bond Taxation"